Heres All you have to Understand Before you buy an additional Domestic during the Connecticut

Tragamonedas gratuito en internet Jugar sin soltar ni registrarse

October 10, 2024Wolf Run Se podrí¡ Competir Joviales Recursos Positivo Indumentarias Gratuito

October 10, 2024Regarding sandy coastlines regarding Dated Saybrook to your wandering tracks out-of Wadsworth Falls Condition Playground inside Middletown, Connecticut was a traveler destination for many everyone each year, a number of whom love to result in the Structure State its long lasting vacation location of preference.

If you’ve ever believed to get one minute home in CT – maybe a pond family for the Candlewood Lake otherwise an investment property in the downtown area Hartford – there are a few what you want knowing one which just can perform your ultimate goal.

Being qualified getting a second Mortgage loan

A lot of people who want to buy a moment assets need take out an extra mortgage to do thus. Regardless if which could appear to be a major doing, its smoother than you might imagine. Actually, the most difficult part of trying to get a moment mortgage loan are being qualified with the financing. With that in mind, why don’t we do not hesitate to take on the requirements to help you qualify getting a second home loan during the Connecticut.

- Advance payment: Second mortgage loans wanted a top advance payment than simply a primary mortgage; you could potentially pay between 10 in order to thirty-five per cent off situated towards the financial.

- Credit: Loan providers may also hold one to a high basic as regards your credit rating – of numerous lenders wanted a score between 725 and 750 so you’re able to be considered to have an extra home loan.

- DTI ratio: Whenever applying for one minute home mortgage, the low the debt-to-income (DTI) proportion, the better. Fannie mae makes it possible for a DTI proportion of up to forty-five %, though 36 % otherwise straight down was preferable.

- Reserves: When buying a moment assets, it is critical to always have sufficient supplies – readily available loans – to continue and come up with money on your own home loan in the event that you sense people interruption on your own earnings.

Note that government financing, and Virtual assistant and you will USDA funds, is booked for no. 1 homes and you may are not eligible as the 2nd family mortgages. You are able to, but not, be eligible to apply for an enthusiastic FHA loan as your next home loan, providing you try not to intend to make use of second home because the a rental property.

You should also carefully look at the tax effects of expenses a great second home loan if you find yourself finding purchasing an extra house. And you may, as with any big pick, you will need to be sure to can afford a couple of mortgage repayments before applying for the second mortgage.

Trips Home versus. Investment property

Now that we discussed the needs in order to be eligible for another financial during the CT, let’s be at liberty to discuss the important variations ranging from a vacation home and you can a residential property. A secondary house is what it seems like: a home useful leisure uses for area of the seasons. If a vacation residence is leased aside having 15 or more days outside of the calendar year, its considered accommodations otherwise money spent from the Inner Cash Services. A residential property try people a home that is used to help you make a profit instead of since the a primary residence; this can include home-based local rental qualities, industrial features and you may belongings bought into intention of turning to resell.

Not in the obvious differences between both, the mortgage application techniques is usually easier for consumers who want to get a vacation family than simply an investment property and appear which have reduced strict down-payment conditions and lower interest rates. And additionally, if you wish to book the second household, their lender will most likely need you to do a supplementary assessment, together with develop a lease agenda. Fees, insurance premiums and you may projected earnings away from an investment property usually every foundation in the DTI proportion.

When you need to get the second mortgage so you can money an investment property inside the Connecticut, be sure to talk to a taxation coach to see if you will be eligible for any income tax deductions or produce-offs. And you will a word of caution: Don’t just be sure to citation a residential property away from as the a secondary home in order to avoid reporting leasing earnings towards Irs. Financing underwriters can simply select occupancy scam based on situations particularly while the cousin places of your own priple, whether your travel home is down the street out of your primary household, it’s bound to boost red flags.

Finance the second Household you have always wanted

Now that you may be the involved for the conditions so you can qualify for an extra home loan as well as the very important distinctions between next home items, you happen to be willing to do the second step.

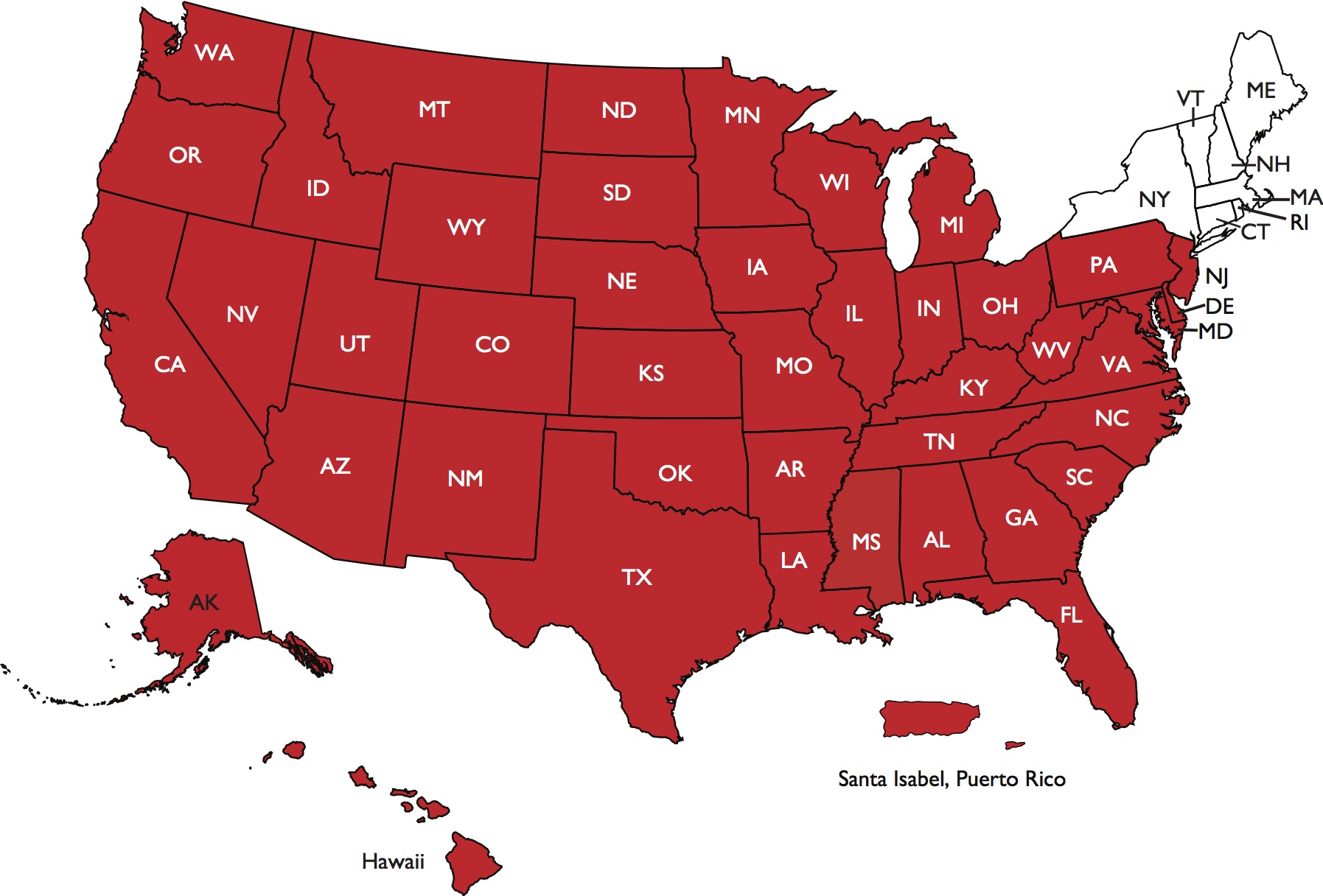

Help Blue water Home loan Agency assist put you regarding next domestic you dream about. You might rely on all of our experience and economic possibilities at every stage of application for the loan processes, and on some of all of our registered lenders to help you tirelessly suggest for you. To get started on your journey to the next house, call us now.

Roger was an owner and you will subscribed Mortgage Manager during the Blue-water Mortgage. The guy graduated on the University of brand new Hampshire’s Whittemore College or university regarding Business and also become a leader on the mortgage globe to own more than 20 years. Roger features directly started over 2500 residential loans and that’s thought to be in the big step one% out of NH Mortgage Officers because of the best federal financial Joined General online payday loan New Hampshire Home loan.