5 What to Know about Your own Home loan Pre-Anticipate Letter off Give

5 Room Domestic found in Zwartkloof Private Games Set aside

November 10, 2024Ils font plein de websites avec celibataires, qu’il parfaitement populaire levant OkCupid

November 11, 2024Big date Blogged:

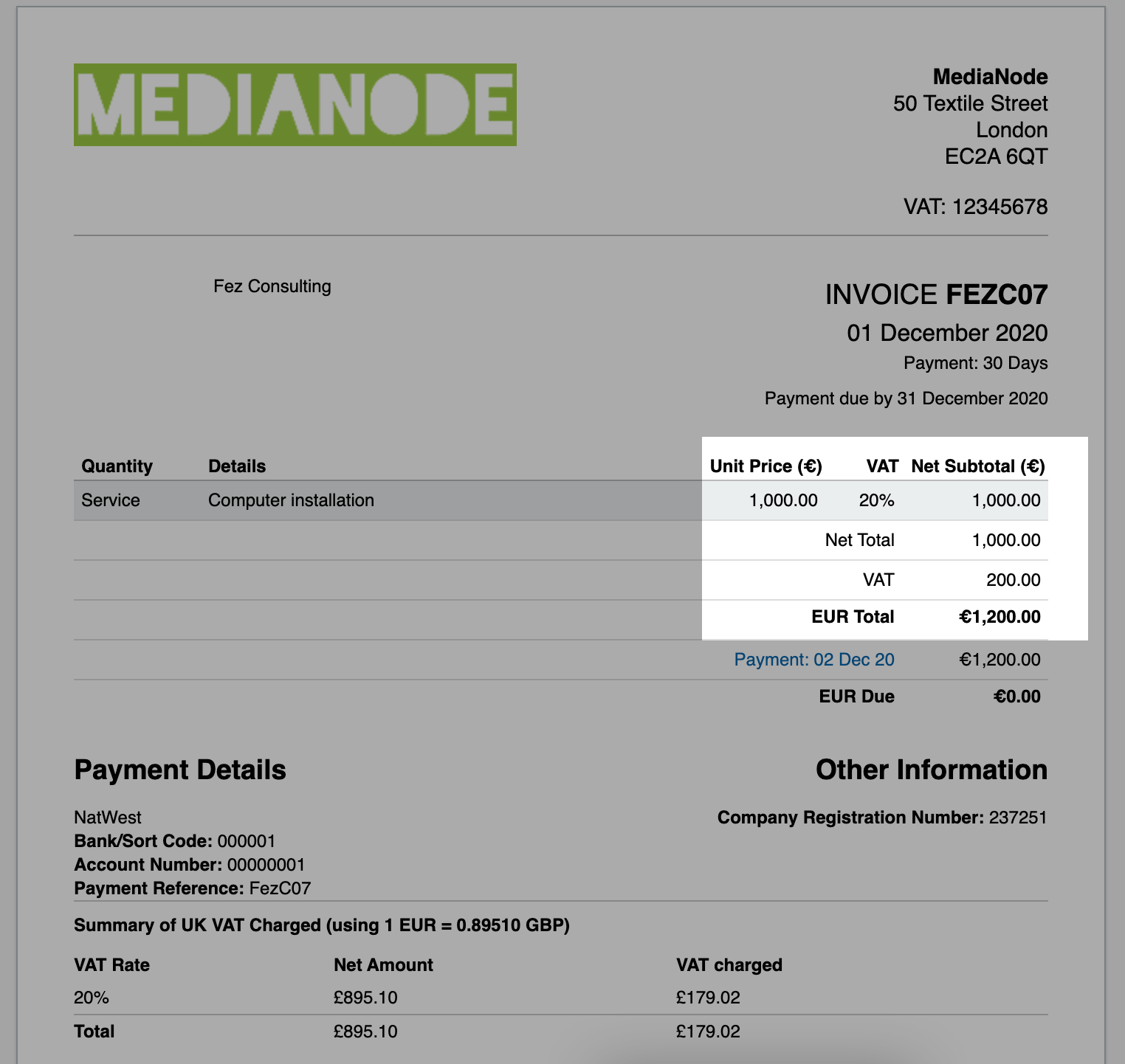

Good news! You’ve completed the job, handed over a hill of files (just joking, our bodies is paperless) and now you’re pre-acknowledged to suit your mortgage! Shortly after a phone call out of your financial adviser our favourite call and come up with, incidentally! might most likely found a file thru current email address which has had this new criteria of your own pre-approval. Most often known as a page from give (or LOO). Check out of the most important components of brand new page:

Projected rates

It’s now a dependence on financial offers to reveal how much expected costs could be. In an effort to not as much as-promise and over-deliver, very banking companies choose to reveal that formula using the low-deal floating speed. That is already up to 9% while a beneficial deal 1 year rates is around seven%.

But do not worry, it is really not joining. Has actually a laid-back look at the typical payments, ensure that they’re what you would imagine he or she is and you may payday loans in Allgood AL disperse into the. Nearer to the newest settlement go out, we’ll discuss particular cost (and regularly a finances share).

Top priority count

During the one financial, the fresh new page out of provide mentions a part ninety five consideration amount. It is always more the borrowed funds count, constantly around step 1.5x and can feel a new source of amaze to own users out of an offer.

The fresh priority is the most the bank has actually top priority more than one further financial. Including, property well worth $700,000 and you can home financing away from $five-hundred,000 might have a top priority out of $750,000. This means the financial institution provides the means to access the initial $750,000 as a result of one income. Making it tough to boost a second home loan up against the house.

While this number seems high, other finance companies has an endless top priority ie; they receive all of the fund (which might be due to all of them) during the a sale.

Unless of course their intention is to try to raise the second financial or rack right up certain really serious appeal fines, the fresh concern matter shouldn’t be out-of instant concern.

Criteria

This is actually the most critical part of the letter out-of promote. You should sort through most of the conditions cautiously and commence ticking them away from as fast as possible. The fresh new standards is going to be not are:

- A finalized sale and get agreement.

- You really have currently considering a duplicate of the product sales and you can purchase contract but the lender should see the document finalized of the one another merchant and you can purchaser. It should additionally be dated (this might be missing in the excitement regarding finalizing!)

- Confirmation out of insurance on property.

- You need to concur that you can make use of insure the property. There are certain reason this isn’t always you can. Unconsented really works or the household situated in a high-quake zone can also be each other cause problems and you can waits.

One thing the offer cannot demand is you remove lifestyle and medical insurance with similar lender that provided your home financing. Put simply, a financial are unable to withhold home financing away from you given that they you usually do not bring their lifetime and you can medical health insurance. You ought to definitely get insurance coverage to protect yourself, it is merely crucial that you make sure it is ideal arrange for your. Communicate with an adviser very early to obtain that it arranged.

Acceptance

Some characters out of even offers are certain to get an affirmation at the end. A place to sign to ensure you want for taking the loan.

Unless you have got all the brand new requirements ticked from and just have finalised the mortgage construction along with your adviser, you don’t have so you’re able to indication that it area.

Expiration go out

Most letters out of offer end once 2 months and that can go-by prompt. But do not care, he is very easy to replenish. Once 8 weeks, all that is needed would be to concur that there were zero significant change to your financial circumstances (you haven’t missing your task otherwise taken out any the new personal debt). The financial institution tend to replenish the latest page off offer to own a deeper 8 weeks. This can be done 2 times (all in all, half a year) before you can need to totally re-apply. The good news is, the online system form you only need to update your info and publish newer and more effective files. Revival is not difficult thus take your time, find the appropriate place for you and don’t get worried concerning the termination go out.

Page of promote realization

The brand new page out of offer ‘s the start of a profitable house get or refinance. As with any deals, you’ll find nothing to worry about with these people as long as you are aware all of them. Banking institutions are not seeking to hoodwink you towards the going for their first-created. Simply read the letter of provide more sluggish and make certain your know what the next phase is. If the in doubt, speak to your property pros.

Home loan Lab’s goal is usually to be the latest electronic town rectangular having economic choice-companies to gain understanding of the newest and you can future home loan. Realize all of us towards Fb and you may LinkedIn or join our very own publication to-be informed of your latest articles.