How can Domestic Security Finance Operate in Minnesota?

Du genre tous les temoignage genesiques influencerait ainsi la verge du charmant bambin

November 3, 2024Welche person Erotik Apps mochte, Ein mochte auf keinen Fall folgende feste Bindung

November 3, 2024Property security mortgage is open new financial potential to own people. Because of the tapping into the value of your home, you can access funds to possess renovations, debt consolidation, otherwise significant expenditures, all the when you are enjoying the competitive costs obtainable in the official.

This article will delve into brand new particulars of household guarantee money in Minnesota, including how they really works, advantages they give you, and the secret conditions you ought to see. Whether you’re considering a timeless domestic equity loan (HELOAN) or an adaptable house collateral line of credit (HELOC), you’ll find out how-to navigate your options and you can maximize your home’s possible.

A house security financing enables you to borrow on this new guarantee of your house, the difference between your house’s worth and you may any a fantastic mortgage balance. So it loan provides a lump sum of cash you’ll want to pay over a fixed label with set monthly premiums, so it is simple to bundle your budget.

When you find yourself questioning just how a house collateral mortgage really works, view it because the the second financial. The quantity you could acquire hinges on the house’s guarantee, credit score, and you may income. Generally, loan providers require you to look after at the very least ten-20% guarantee in your home after the loan.

To apply for a property guarantee financing, you’ll need to collect various economic records, and additionally paystubs, W-2s, and you may tax returns. While you are self-employed otherwise has varied earnings, think about the lender declaration HELOAN. This domestic security mortgage makes you meet the requirements having fun with step one-2 yrs regarding financial statements, simplifying the procedure and you may providing alot more flexibility.

Remember, with your household as the guarantee form you chance foreclosures for individuals who neglect to build payments. Therefore, it’s vital to consider carefully your financial predicament and you may upcoming agreements ahead of investing property security mortgage from inside the Minnesota.

Form of Household Collateral Loans

There are 2 form of house guarantee fund inside the Minnesota: the conventional household security mortgage and the house collateral distinct credit (HELOC).

A home security financing even offers a lump sum payment of money having a predetermined rate of interest and you can monthly payments. These mortgage is ideal for extreme costs including home home improvements otherwise debt consolidating. Family equity financing costs during the Minnesota may vary, so it’s best if you contrast also offers.

Likewise, a house collateral line of credit (HELOC) characteristics more like a credit card. You can borrow as required, to a-flat restrict, and only pay attract about what you employ. HELOCs routinely have varying prices, and that’s useful if rates try lower but could rise throughout the years.

When considering a HELOC compared to. a home collateral financing, think about your economic needs and you may commission preferences. Minnesota family security loans provide stability, while HELOCs offer flexibility. It is critical to purchase the choice that most closely fits your financial problem and you will goals.

Advantages and disadvantages out-of Minnesota Domestic Equity Fund

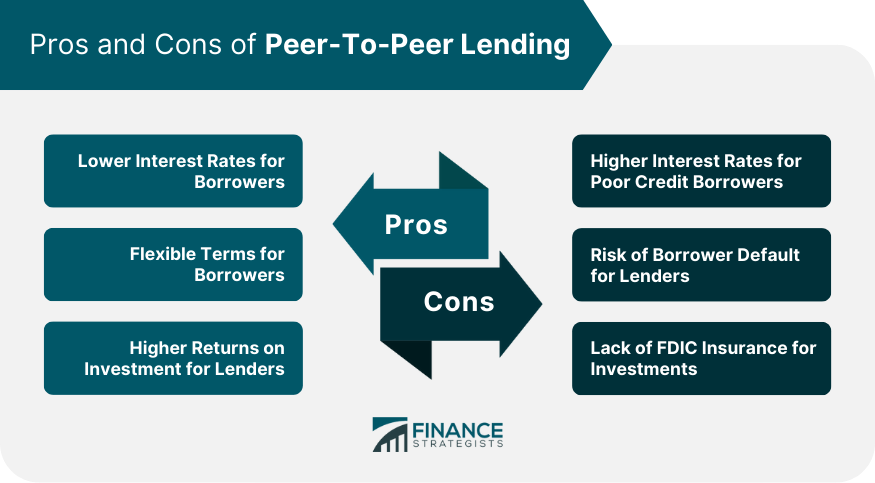

Home security financing during the Minnesota should be a great way to availability money, but it’s crucial that you consider the benefits and you will downsides:

Experts out of household equity loans:

- Fixed interest rates: Of many Minnesota domestic security fund give stable prices, while making budgeting much easier.

- Lump sum: You receive the entire amount borrowed initial, that’s ideal for higher expenditures.

- Possible tax professionals: Attract may be income tax-allowable in the event the used in renovations.

- Short monthly payments: As compared to higher-interest handmade cards or signature loans, the brand new payment per month on a home equity loan will be apparently reasonable.

- Keep first mortgage: You can access their home’s security while keeping your existing reasonable-price first mortgage intact.

Downsides from household guarantee money:

- Risk of foreclosures: You reside equity, thus skipped money could lead to loans Hanover property foreclosure.

- Financial obligation increase: You might be including far more loans on established home loan, which will be risky if the home values drop-off.

- High rates of interest: Family equity loan pricing into the Minnesota usually are higher than the individuals to possess a first traditional mortgage.

How-to Qualify for a home Guarantee Mortgage inside Minnesota

Being qualified to possess a property guarantee mortgage for the Minnesota involves conference trick requirements. Insights these may make it easier to prepare while increasing your odds of recognition. This is what you usually have to be considered:

- Loan-to-really worth (LTV) ratio: Brand new LTV proportion was calculated from the separating the amount you borrowed from by the house’s appraised well worth. For example, if for example the home loan balance is $120,000 along with your residence is appraised from the $160,000, their LTV proportion could be 75%. Loan providers generally prefer a keen LTV ratio off 80% or lower to minimize risk.

To have an easier application techniques, consider utilizing the fresh new Griffin Silver application. It assists your having cost management and you will investment, making it easier to handle your debts during the software techniques.

Sign up for property Collateral Mortgage in the Minnesota

Making an application for a home collateral financing inside Minnesota will likely be good smart financial circulate, whether you are looking to fund renovations, consolidate debt, otherwise availability more funds. By tapping into the house’s collateral, you can secure a loan with aggressive rates. To get started, be sure to meet up with the secret conditions, like which have sufficient home security, good credit, and you will a manageable personal debt-to-income proportion.

To try to get property guarantee mortgage from inside the Minnesota, contemplate using Griffin Financing. Griffin Resource will guide you through the app procedure, working out for you maximize your household guarantee. Do the first rung on the ladder today to discover the residence’s monetary possible.